Back

UK Economic Growth Slows to 0.3% with Construction and Services Growing

- 14 Aug 2025|

- News|

- Posted by Martyn East

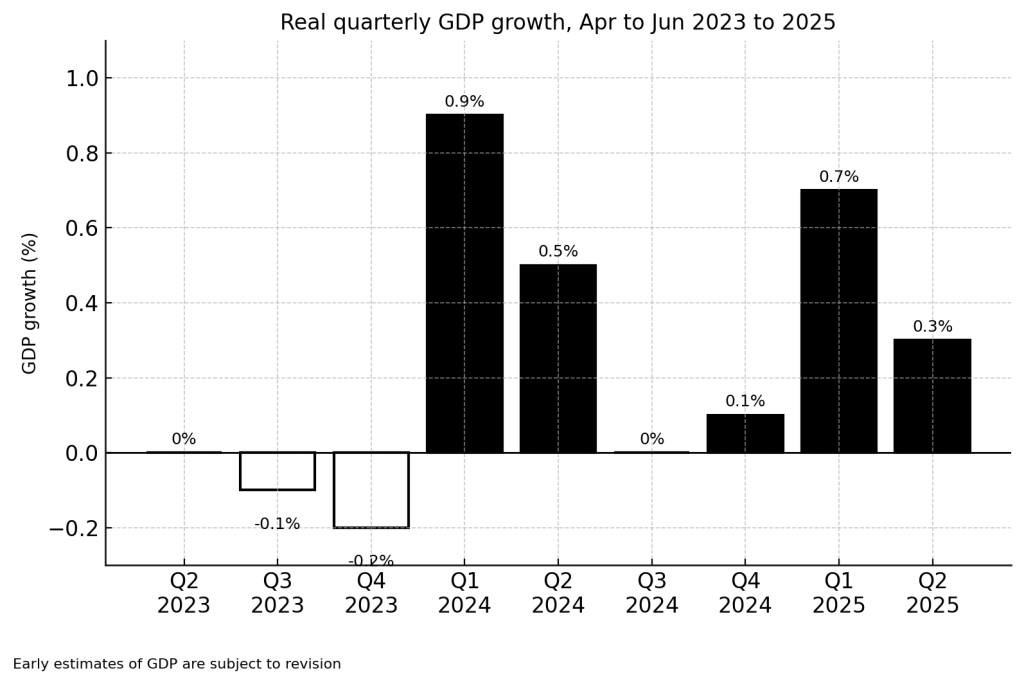

UK economic growth slowed to 0.3% between April and June 2025, according to the latest Office for National Statistics (ONS) figures. This is down from a robust 0.7% in the first quarter, but stronger than the 0.1% expansion economists had forecast. The economy’s performance was driven by a resilient services sector and a 1.2% rise in construction output, offsetting a 0.3% fall in production industries.

The quarterly slowdown follows a period of exceptional growth at the start of the year, partly fuelled by businesses accelerating activity to get ahead of Donald Trump’s new US trade tariffs and homebuyers rushing to complete before UK stamp duty threshold changes in April. The ONS also revised April’s GDP contraction from –0.3% to –0.1%, helping lift the quarter’s overall performance.

For companies in the building products, home improvements, construction, property, and professional services sectors, the latest data shows a market that remains active despite tighter economic conditions. Infrastructure projects, repair and maintenance demand, and professional service needs continue to underpin growth opportunities.

Detailed GDP Performance — June & Q2 2025

Monthly GDP (June 2025)

- GDP rose 0.4%, beating forecasts of 0.1%.

- Services: +0.3%

- Production: +0.7%

- Construction: +0.3%

Quarterly GDP (Q2 vs Q1)

- Overall GDP: +0.3%

- Services: +0.4%

- Construction: +1.2%

- Production: –0.3%

Year-on-Year

- GDP up 1.1% compared to Q2 2024.

- Construction up 2.2% year-on-year.

Political & Economic Context

Chancellor Rachel Reeves called the figures “positive” for an economy that “has felt stuck for too long” but stressed that “there is more to do” to deliver stronger and fairer growth. She highlighted planned investment in infrastructure, a reduction in regulatory barriers, and an increase to the national minimum wage as part of her “Plan for Change”.

Opposition parties took a different view. Mel Stride, the Conservative shadow chancellor, accused Reeves of “economic vandalism”, citing a projected £50bn gap in public finances, while Daisy Cooper of the Liberal Democrats criticised the pace of growth as “snail-like”.

Economists offered a mixed outlook. Ruth Gregory of Capital Economics warned that the UK may struggle to maintain this growth rate in the coming months due to a weak global economy, the delayed impact of April’s tax rises, and consumer caution ahead of the Autumn Budget. James Smith of ING Bank described the result as “not bad” given the headwinds, noting that hot, dry weather had helped boost construction output.

What This Means for Your Core Industry

The ONS data confirms that construction, building products, and professional services remain strong contributors to the UK’s economic resilience. The 1.2% quarterly increase in construction output reflects steady demand in repair and maintenance (R&M), housing improvements, and infrastructure delivery, all areas where businesses with clear market visibility can win consistent work.

For professional and technical services, growth in architectural, engineering, and consultancy activity indicates sustained demand for specialist expertise. In the home improvements market, continued consumer spending on upgrades and energy efficiency projects creates opportunities for suppliers and contractors who can market themselves as reliable, responsive, and competitive.

Strategic Industry Summary

| Sector / Focus | June 2025 | Q2 vs Q1 | Strategic Opportunity |

| Construction (R&M & Infra) | +0.3% | +1.2% | Promote R&M and infrastructure expertise |

| Professional & Technical | +1.7% (monthly) | Services +0.4% | Position as a trusted specialist partner |

| Building Products Supply | +0.7% (production) | –0.3% | Highlight reliability and speed of delivery |

| Property & Real Estate | N/A | Indirect gains (services) | Emphasise design-led, compliant, sustainable solutions |

Closing Outlook

The UK’s Q2 GDP results show a steady, if slower, rate of expansion, with construction, services, and technical expertise leading the way. For businesses in construction, building products, home improvements, property services, and professional sectors, the opportunity is clear: position your brand in front of active buyers, leverage sector-specific growth trends, and communicate your capacity to deliver on time and to specification. By targeting the areas of the economy that are performing, from infrastructure to R&M, you can gain market share even in a more cautious economic climate.

Position Your Business for Growth in a Slowing Economy

Andrew Scott, CEO of Purplex Marketing, said:

“When markets slow, the winners are the companies that refuse to sit still. Now is the time to double down on your marketing, sharpen your message, and get in front of the people making decisions. The businesses that act decisively today will dominate tomorrow’s market.”

The latest ONS figures show the UK economy grew 0.3% in Q2 2025, with construction, building products, property, and professional services among the sectors still seeing positive output. In a climate of slowing growth and shifting market conditions, your business cannot afford to stand still. Strategic marketing, targeted SEO campaigns, and high-impact PR and communications will be the difference between those who thrive and those who fall behind.

Purplex works with ambitious companies in your industry to help them win more contracts, strengthen customer relationships, and maintain momentum when competitors hesitate. From strategic consultancy to PPC advertising, social media marketing, and creative design, we deliver measurable results. Our expertise also includes web design, e-commerce solutions, and video production giving you everything you need to put your brand in front of decision-makers and secure your share of the market.

📞 Call us on 01934 808132

✉️Email Us grow@purplexmarketing.com

💻 Visit our Contact Page

You might like to read

If you found this analysis useful, here are more Purplex insights into market performance and business growth strategies:

- UK Construction Market Overview – Analysis of market performance and trends in the construction sector.

- Proven Marketing Strategies for Your Construction Company – Practical insights for winning new work in competitive markets.

- Exploring the Advantages of Personal Branding for UK Construction Companies – How reputation impacts lead generation and client retention.

- Marketing Your Way Out of Low Growth – Strategies to overcome slow market conditions.

This entry was posted in News